In one of my previous articles, I described the craziness around Apple (AAPL) options as reflected by the options premiums. At some point, the IV (Implied Volatility) jumped to 41%.

I presented the following butterfly trade as one possible way to take advantage of this inflated IV:

- Buy 1 AAPL April 550 call at $47.95

- Sell 2 AAPL April 600 call at $21.97

- Buy 1 AAPL April 650 call at $8.92

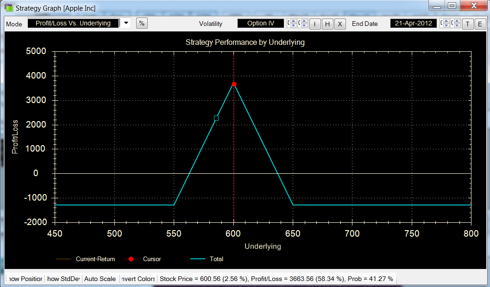

The options prices are based on closing prices on Friday, March 16, 2012. The trade could be done for $12.80 debit. The stock closed at $585.57 that day. The P/L graph looked like this:

The trade could be done for a $1,280 debit. This is the maximum you can lose. The maximum gain is realized if the stock is at $600 at April expiration. In this case, the trade will be worth $5,000. That's a 1:3 payoff. Of course, the probability of this happening is very low - as we know, risk/reward is directly related to the probability of success. But if the stock stays in the $590-$600 region for the next few weeks, the trade will slowly gain value.

However, what is more important is the fact that the trade is vega negative - it benefits from decreasing IV. The thesis was that at some point, the April IV will have to come down, and it will benefit this trade. The break-evens at expiration are $562 and $637.

Fast forward one week - here are the prices of those options on Friday March 23, 2012, with the stock closed at $596.05:

- AAPL April 550 call: $51.10

- AAPL April 600 call: $17.85

- AAPL April 650 call: $3.85

Please note that 600 calls actually lost almost 20% while the stock is up 11 points. The butterfly trade is worth now $19.25, a whopping 50% gain, while the stock moved just 1.8%. Too bad I didn't execute the trade. But some of my readers did and made 40-50% in just few days.

So what happened here?

Two words: Implied Volatility. This trade clearly shows you how you can make big money by understanding the Implied Volatility and lose big money by ignoring it. The thesis proved to be correct much faster than I expected. IV went from 40%+ to under 30%. This is a huge drop in just few days. We purchased the 550 and 650 calls which had relatively little time value, and have been impacted less by IV crash. At the same time, we sold the 600 options which had most of the time value, and lost the most from the IV collapse.

I started getting emails from some of my readers: "Kim, I bought some 600 calls. The stock is up more than 10 points - how is it possible that I'm losing money on them?"

As usually, some Apple bulls criticized the trade. For many of them, anything less than speculative Out Of The Money calls are sign of bearishness, and being bearish on Apple is almost a crime those days. That's fine with me. I respect different opinions. This is what makes the markets, isn't it? After all, if everyone understood Implied Volatility, who would buy those 600 calls from me when I need to sell them?

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

How useful was this article?

Did you find this article useful?

Yes No

Sending feedback...

Thank you! Your feedback will help us better serve you and other readers.